car insured prices cheapest car cheapest car insurance

car insured prices cheapest car cheapest car insurance

What is a comprehensive insurance deductible? A detailed insurance deductible is the sum of money that you are accountable for paying towards an insured loss - insurance affordable. The quantity of the deductible is subtracted from your claim settlement in case of a protected accident. Commonly, detailed deductibles range from, as vehicle insurance deductible choices differ relying on your state laws and insurer standards.

Why you may not desire a high detailed insurance deductible? A high insurance deductible can indicate that you need to pay even more expense in case of a mishap or various other covered loss - affordable auto insurance. This can be especially problematic if you don't have a whole lot of savings or emergency funds to cover these expenditures. cheap.

Because of this, you might not have the ability to obtain the complete quantity of coverage you need if you have a high insurance deductible. Having a greater insurance deductible makes it extra difficult to get approved for particular discount Additional hints rates. For instance, lots of insurance provider provide price cuts for low-mileage motorists. However, if you have a high deductible, you may not have the ability to get these discount rates.

One of the most your insurance will payout is the automobile's real cash value what the car was worth on the market before the damages occurred minus your picked insurance deductible amount. You can negotiate the real cash value of your vehicle in the occasion of a total loss by giving different instances of similar autos.

Thorough insurance claims and also your rates, Many states' insurance regulations require that extensive claims be covered by the plan. The exception might be if you submit several cases in a really brief period of time.

The Best Guide To What Happens If You Can't Afford Your Deductible?

What is an insurance deductible? A deductible is the quantity you pay of pocket towards repair services for your automobile as a result of a covered loss. If you have a $500 insurance deductible as well as you're in a mishap that results in $3,000 of repairs to your vehicle, you pay only $500 towards repair services (risks).

credit score low cost suvs credit

credit score low cost suvs credit

In a lot of markets, when you're not to blame for an accident, we can waive the insurance deductible if we can recognize the various other celebration, that they're at mistake, and their insurance coverage service provider verifies they have legitimate responsibility coverage for the mishap. This investigation can take time, so the insurance deductible may apply at the beginning of the claim and also be compensated later - cheapest car.

Your insurance deductible only applies when your insurance coverage firm pays for your vehicle fixings. There is no insurance deductible if the various other celebration's insurance policy is handling the repairs.

insure business insurance affordable trucks

insure business insurance affordable trucks

Whether you're a brand-new vehicle driver or have lagged the wheel for years, it can be daunting to learn insurance terminology like "insurance deductible." Your automobile insurance policy deductible affects the expense of your insurance policy, so it is very important that you select one thoroughly (auto). The insurance deductible that's right for you depends upon your specific situations. automobile.

How does an insurance deductible work? An insurance deductible is the amount of money you pay out of pocket before your insurance protection kicks in as well as starts paying for the prices of your loss. affordable car insurance.

Unknown Facts About How To Choose A Car Insurance Deductible - Root® Insurance

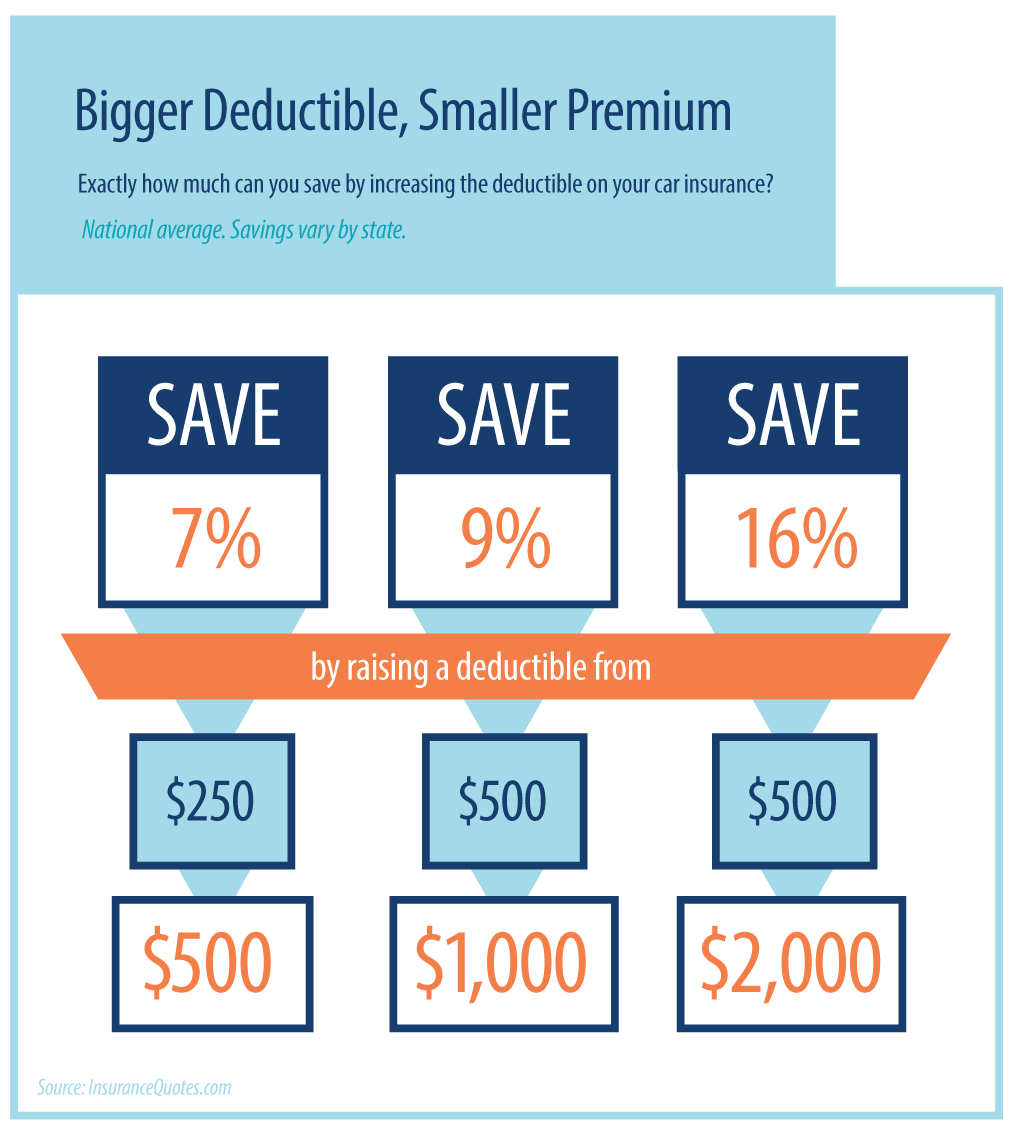

Not all insurance policy protections call for a deductible, however if your own does, you'll pick the quantity. Your insurance deductible will certainly impact your month-to-month insurance repayment the reduced your insurance deductible, the greater your automobile insurance costs. When purchasing quotes from auto insurance coverage business, explore just how various deductibles will influence your regular monthly repayments.

Auto insurance coverage policies can consist of various kinds of coverage that offer differing purposes, and you can select to be covered by some or all of them. State law typically establishes whether or not an insurance deductible is required.

This covers you if your vehicle clashes with one more car or object and you require to pay for repairs. prices. Collision deductibles are typical however vary by insurance company. If your vehicle is damaged by an occasion such as fire, a dropping things hitting your windshield or criminal damage, you'll file a thorough insurance coverage insurance coverage case.

Deductibles are sometimes needed for this insurance coverage, yet not constantly, and requirements vary by state. While your automobile insurance policy deductible can vary considerably depending on many variables, including how much you desire to pay, car insurance policy deductibles usually vary from $100 to $2,500.

When selecting a deductible, you'll require to consider several elements, including your budget (credit score). Invest time computing just how much you can pay for to spend for a deductible and just how much you'll reduce your monthly costs by choosing a greater one. Ask yourself these questions when selecting a deductible quantity.

8 Easy Facts About Understanding Your Auto Insurance Deductible - Mutual ... Shown

You require this buffer in case the worst happens, however if you're a risk-free chauffeur or do not drive typically, utilizing an emergency fund to cover any type of accidents may be an option. This is an important inquiry when considering what insurance deductible to pick. If you enter an accident, can you manage the insurance deductible or would you have a hard time to pay it? Tackling a high deductible might not make much feeling if it stands for a big portion of the vehicle's worth.

Anytime you're in a cars and truck accident and also there are problems to your car that would certainly be covered under extensive or collision coverages, you'll be accountable for paying the insurance deductible under each of those protections. You can select various deductibles within your car insurance policy plan for both accident and comprehensive. If you have several cars on your auto insurance policy, you can likewise choose different deductibles for every automobile.

You can pick various protection restrictions for all of them, as well as set deductibles, depending on which protection it is. Why can't you constantly select your insurance deductible?

In short, a higher insurance deductible amounts to lower insurance coverage costs. A reduced deductible amounts to higher insurance costs.

This falls under collision protection. When picking vehicle insurance coverage, you picked the reduced insurance deductible of $500. The insurance provider would certainly currently have to pay $9,500. What if you picked a high deductible of $2,500? Then the insurance firm would only need to pay out $7,500. They have much less risk, so you'll pay a reduced premium.